about us

Florida Property Tax Consultants, Inc. has been focused on property tax appeals since the firm’s founding in 1997. Our 30+ years of local experience and extensive familiarity with the real estate market enable us to get results. We consistently save our clients money by lowering their property taxes, which increases their NOI and value. Results are what we are all about.

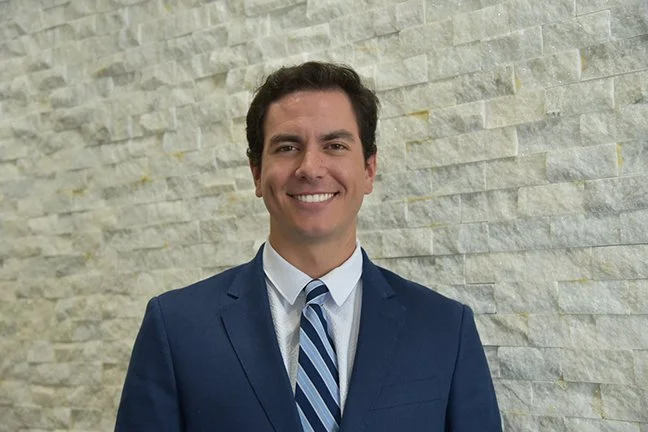

The FPTC team consists of experienced professionals with backgrounds in valuation, investing, appraising, and brokerage. Leading the team is Juan C. Figueras, Founder, and President of FPTC. His track record of success has earned him a reputation as one of the leaders in this specialized field.

Juan C. Figueras, President

Juan is a Miami native with over 35 years of experience in property tax appeals and real estate analysis across Florida. Since beginning his career in 1989, he has established himself as a trusted expert who consistently delivers results.

Before founding Florida Property Tax Consultants, Inc. in 1997, Juan gained valuable experience working for two national property tax consulting firms. His decision to focus on South Florida clients has made him a recognized local authority in the market. Juan attributes his success to his extensive experience, deep market knowledge, and strong relationships with Property Appraiser Offices, Value Adjustment Boards, and Tax Collector Offices throughout the region.

He holds bachelor’s degrees in Real Estate and Finance from Florida State University. Juan was a Certified Member of the Institute of Professionals in Taxation (CMI) and maintains his license as a Florida Real Estate Broker. He is also an active member of both the Florida and National Associations of Realtors. Committed to staying current with the evolving property tax laws and administration in Florida, Juan continues to engage with the Florida Association of Property Tax Professionals (FAPTP), an organization he helped establish in the early 1990s.

-

Wesley Strump

SENIOR CONSULTANT

Wesley is a Senior Consultant at Florida Property Tax Consultants (FPTC), where he has been a key team member since 2018. Born and raised in Miami, Wesley offers in-depth knowledge of the Miami-Dade area and the broader Florida real estate market, an advantage that has helped him lead thousands of successful property tax appeals.

Wesley is a licensed Florida Real Estate Broker and holds a degree in Finance and Real Estate from Florida State University.

At FPTC, Wesley prepares, presents, and manages operations for all of the firm’s property tax appeals, with a primary focus on commercial assets. With over 10 years of experience in the property tax appeal field, he brings both expertise and a proven track record to every case. His strong professional relationships and deep knowledge have contributed to successful outcomes across all types of properties presented at the Value Adjustment Board.

He provides expert guidance in pre-acquisition and pre-construction due diligence, delivering accurate tax estimates that help clients make strategic, cost-effective property decisions while working to maximize their Net Operating Income throughout ownership.

In addition to consulting, Wesley took the lead in developing a strategic marketing plan that helped double FPTC’s tax appeal portfolio. He remains committed to delivering exceptional results and strategic value to his clients across Florida.

-

JESSICA LINTON

DIRECTOR OF OPERATIONS

Jessica joined FPTC in 2016 and has since become an integral member of the firm’s leadership team. As Director of Operations, she provides high-level support across the organization, overseeing day-to-day activities and ensuring smooth operations. She plays a key role in driving the company’s growth and profitability by developing and refining business processes that enhance workplace quality and efficiency.

Jessica specializes in client management, database development, and system implementation. She oversees essential administrative functions, including accurate client recordkeeping and the coordination of annual property tax appeal filings. She works directly with clients to identify potential savings in their property tax assessments, ensuring no opportunity is overlooked.

She is known for her determination to get to the bottom of any issue—always ready to research solutions and approach new challenges with innovation and dedication. Jessica’s strategic oversight and hands-on leadership consistently drive progress and deliver results.

-

RICK ABELLA

SENIOR REAL ESTATE ANALYST

Rick serves as FPTC’s Senior Real Estate Analyst, where he specializes in constructing persuasive case documentation and providing strategic consultation to property owners seeking tax relief. With over 15 years of experience in real estate valuation and ad valorem tax appeal, Rick brings a deep understanding of assessment methodologies and jurisdictional tax practices.

A graduate of the University of Florida, Rick holds a bachelor’s degree in Geography with a minor in Urban and Regional Planning. He also maintains an active Real Estate Sales Associate license and has completed advanced coursework in all three recognized approaches to real estate appraisal: cost, income, and sales comparison.

A Miami native, Rick, possesses in depth knowledge of the region’s diverse neighborhoods and municipal assessment policies, insight that enhances his ability to challenge improper valuations and secure favorable outcomes for clients. Committed to professional growth, Rick believes ongoing education and enthusiasm for his work are key to delivering successful tax appeal results and maintaining strong client relationships.

-

Kyle Knott

REAL ESTATE ANALYST

Kyle is an Orlando raised licensed Real Estate Sales Associate serving as a Real Estate Analyst at Florida Property Tax Consultants, Inc. Having lived in four different cities across Florida, he brings a broad and nuanced understanding of the state’s diverse local markets. Kyle holds a Bachelor of Science from Florida State University and is pursuing his Certified Commercial Investment Member (CCIM) designation, the industry’s premier certification in commercial and investment real estate, providing advanced training in market analysis, financial modeling, and strategic negotiation.

In his role as an analyst, Kyle supports both residential and commercial property tax appeals by applying his expertise in data analytics and cutting-edge technology to enhance precision and efficiency. He conducts research and analysis that provides the essential insights needed for successful appeals. He is also licensed to appear on behalf of clients at Value Adjustment Board hearings for all property types. Clients trust Kyle as a reliable source of up-to-date market information in an ever-changing landscape, confident that he delivers data-driven advice tailored to their needs.

-

Daniela Lizarazo Caicedo

ADMINISTRATIVE ASSISTANT

Daniela serves as the Administrative Assistant, providing support in coordinating daily operations and managing property tax documentation. She helps maintain accurate records of the company’s real estate portfolio and ensures that all property tax matters are handled in a timely and organized manner.

Daniela plays an important role in client communication, ensuring clear and efficient interactions regarding property tax processes, deadlines, and required documentation. She supports the team by assisting with property tax contract processes, performing data entry, responding to emails, and answering phone calls to provide clients with prompt and helpful assistance.

With strong organizational skills and a client-focused approach, Daniela contributes to the firm's ongoing commitment to service, professionalism, and operational efficiency.

-

Kris Figueras

BUSINESS AND TECHNOLOGY ADVISOR

Kris brings a wealth of experience in technology and business consulting to her role at Florida Property Tax Consultants. She began her career at Coopers & Lybrand as a software development consultant and went on to work with a variety of consulting firms and major corporations, including Sensormatic and Motorola, where she served in key IT consulting roles. Over the years, she has developed deep expertise across every phase of software development, including business analysis, project management, and implementation.

At Florida Property Tax Consultants, she serves in an advisory and consulting capacity, supporting a range of strategic and operational projects. Her extensive background in IT and business process improvement allows her to contribute meaningfully across departments, bringing structure, efficiency, and innovation to each engagement.

One of her key contributions to the firm is in business process redesign, where her ability to streamline workflows and enhance organizational performance adds significant value to both the company and its clients. Her diverse skill set and commitment to excellence make her a vital part of the Florida Property Tax Consultants team.